2022 Aug Portfolio Update

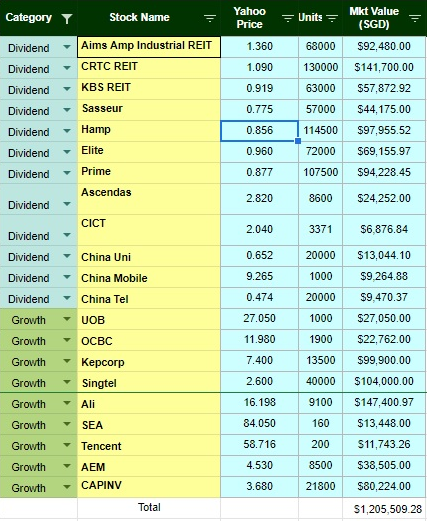

As of 3rd of September, portfolio value is around 1.2m. Compared to the previous round of update for July, it went down 35k. Which is around 2.8% of portfolio. I attribute this to the ex dividend effect and also the macro environment remains volatile.

There are too many things plaguing the world right now ( At least my portfolio haha).

1. The Russia - Ukraine War - Everyone thought this will be quick. The war started before I handed in my resignation letter. It's still on going 2 months after I left my job.

2. Inflation - No thanks to the war as well.

3. China's Covid Policy - As a big chunk of my portfolio is pure china play (31%), naturally the share price is either stagnant or impacted, for example Sasseur and CLCT

I dont plan to do any adjustment to the portfolio. For the China related stocks, let's see what happens after China's 20th Congress meeting in mid October.

Why the confidence in Singtel? ;-)

ReplyDeleteI started accumulating singtel at lower prices. So now it is giving me approximately 10% capital gains and around 4% dividend, so it is not that bad and I think with the borders opening up, revenue will be boosted by the roaming charges. Just my thoughts.

DeleteThanks for sharing this. With the Fed signalling determination to fight inflation, interest rates are likely to increase / stay high. This will negatively impact REITs. You seem undeterred by this though, care to share your thoughts please? Thank you.

ReplyDeletehaha, actually you can also ask why do I seem undeterred by the things happening in China as well as I am holding a big bag of china play stocks.

DeleteAnyway back to the interest rate hurting REITs question. I feel that this is more of a self fulling prophecy than anything else. When people hear that interest rate will go up, people start to sell off REITs as higher interest rate will hurt REITs. But does it really hurt REIT? Of coz it does, as borrowings become more expensive which will hurt the bottom line and thus the DPU is impacted, theorithically speaking. So when more people start to sell off REITs, price will drop and everyone starts to say "See, interest rate hike will hurt REIT price". However, this is not the first time interest rate is going up, we have been kept at a prolonged artificial rate of close to 0 for a very long time since the 2008 GFC. When we dig deeper, does hike in interest rate really hurt the REITs? Normally interest rate is increased due to better economic sentiments which translate to more jobs, booming business and more demand for commercial/industrial/retail spaces. I actually captured my thoughts here in this post.

https://happyreitinvestor.blogspot.com/2022/06/4-reits-that-defy-interest-rate.html

Of coz the disclaimer here is , things are abit different. Interest rate is hiked to fight inflation and the economy is somewhat still reeling from Covid Pains. The reason is different from the usual reason why interest rate is increased.

Now I sound like I am contradicting myself. Sounds like perhaps this time around it is really not that sensible to hold on to REITs. Even though my blog title is happy reit investor, my portfolio is no longer fully REITs unlike a year or 2 years ago. It is 52.5% REITs nowadays.

A big chunk of my REITs is in China as I am banging on the reopening of China, though I am losing hope. Lol. Need to see what happens next after the China Congress in Oct.

Another chunk is the the US as I wouldnt bet against the resolve of the USA to ensure a soft landing with regards to fighting inflation. I wouldnt say the same of Europe which is highly dependent on the Russia for gas.

If you are interested in the breakdown of my portfolio, it is here.

https://happyreitinvestor.blogspot.com/2022/07/my-portfolio-allocation.html.

Just wondering how is your investment approach like?

another disclaimer is, dont buy dodgy REITs!

DeleteHi Happy Reit, thanks so much for the detailed response. In particular, your link to your article "4-reits-that-defy-interest-rate" has been insightful. We are in similar age group, family structure (2 kids) and my asset for investment is around 10% lower than what you shared publicly. Have been facing lots of pressure at work in recent years, and hence, passive income has become more important. I am too risk adverse though, I am in 80% cash right now but I want to start buying slowly. I think all the 4 reits you listed in the article are sound choices and have become very attractive - I am queing at bid price everyday. Yes, agree with your point no didgy reits, so I am going for brand name sponsors Reit at this time. Besides reits, I plan to start accumulating SPY or QQQ via DCA from Oct on wards. Speculating that there is one more leg down before building a bottom - but I think there will not be V shape recovery as FED cannot drop interest rates any time soon. Really appreciate your generous sharing. Keep doing it ya, your posts are giving people hope, knowledge and positive energy. Thank you and God bless you and your family. :)

DeleteGood to know that my blog provides some form of positivity in the midst of all the negativities in the world right now. Yes, you definitely should make your spare cash work for you, that's a massive horde!

Delete