FINANCIAL REPORTING - OCBC and Ascendas REIT

I mentioned last week that I was put on waiting list for my RES exam. Unfortunately I didn't get the slot this time. I have mixed feeling about it. Part of me is actually delighted as I can continue to live a "retiree" life, another part of me was a little disappointed as I was all raring to go after the RES course. Such is life. I am actually feeling a little lethargic today as I slept later than usual last night. I was so excited with the whole Pelosi to Taiwan event and I was waiting to find out what was China going to do about it after their "dont say I never warned you" warning. In the end, it was nothing much. Good in the sense, cool heads prevail. The world definitely doesn't need another major war.

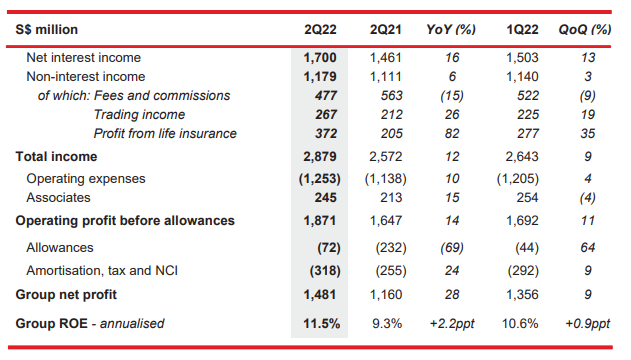

OCBC

OCBC is the other bank stock I have. Will continue to hold OCBC as banks will do well in rising interest environment. Dividend of 28 cents declared. All in all, it's giving me around 6% yield. Not bad at all.

Hi, It's me again. Yeah, last night was pretty exciting, I was watching Flightradar24 for SPAR19 since 8pm until the system hang towards the landing:p Then switching to news websites and youtubes for any new responses from PRC, thankfully nothing happened, that triggered a small run up of some US stocks as well as SGX and HKEX stocks today, unfortunately I sold my PLTR too soon at 10.66 that I missed the run up to >11.00....fed up then I go koon b4 12....that was considered early by my std :lol:

ReplyDeleteOut of the 3 banks, I used to hold a lot of OC because every analyts say this is the best among the 3, however it performed the worst for me, so today's results is kind a surprise....I cash in some of my DBS today at 32.2 but it continued to run up to 32.3 now....I guess the results must be good tomorrow...lets see. As for UOB, this again frustating me, the gap to DBS is about $5 now....I intend to diamond hand until 7 Aug....my strategy for UOB is I always track this to DBS...the price gap use to be aligned but it has since widerned more and more this year, hence my holding is comparable larger on UOB vs DBS.

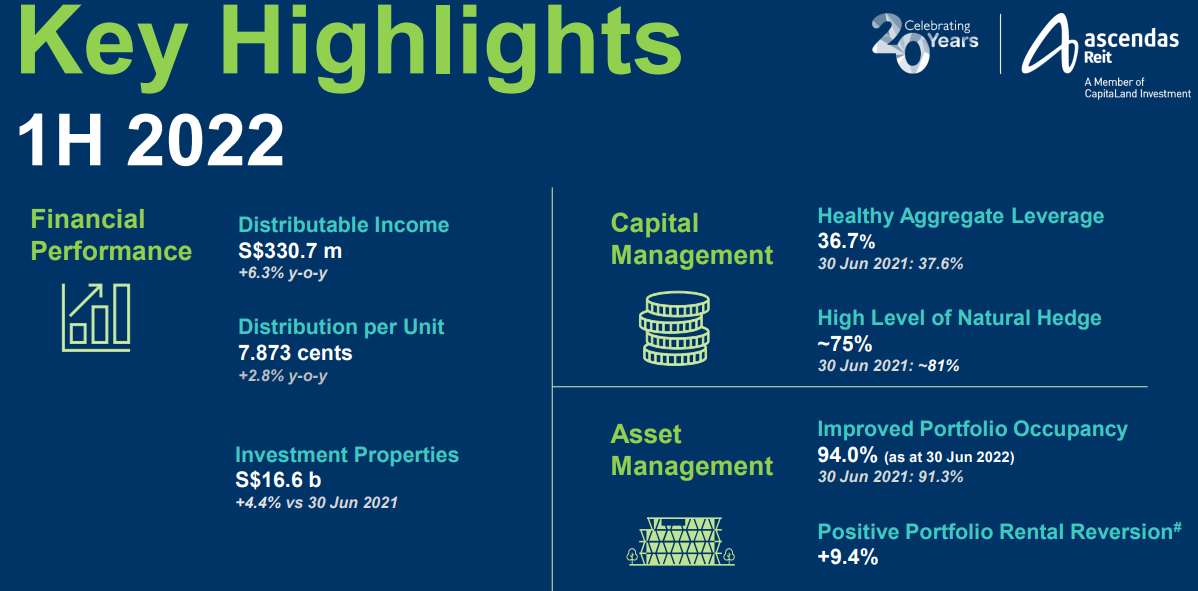

I cannot own Ascendas due to company restriction, I guess I can start looking at some of these liao but gut feel telling they are not attractive, yield wise :p

Enjoy your dividends!

ReplyDelete