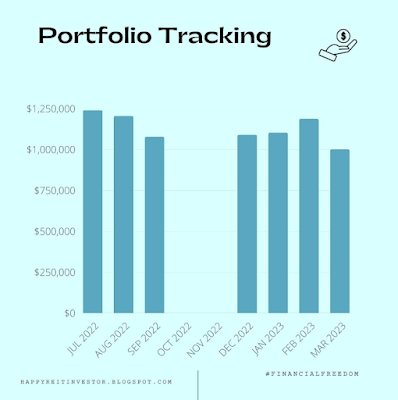

2023 March Portfolio Update

March portfolio update. Still clinging on to 7 figures, barely @ $1,001,216. What a difference a month make! Portfolio dropped by ~15%. BTW, this is not my networth. I stopped counting that for now as the fluctuation is mainly because of my investment portfolio.

Looks like the market has found another reason to shit its pants again. All that is happening now sounds very deja vu, very 2008 like. Big banks closing down, the abbreviation CDS is back in vogue again.

All this in the midst of high inflation. wondering how it will all pan out in the end. I am not doing anything to tweak my portfolio, if anything, i will buy more.

Are you going to adjust/balance your portfolio? What's your plan?

Personally, I expect and hope for greater falls ahead.

ReplyDeleteAmong my counters, the worst hit was Digital Core Reit (behaving more like a leveraged tech stock). But otherwise, overall the fluctuations were not that much (think HK/China banks and SG banks, local Reits are less impacted).

My preference is always to add to the counters in my portfolio first, unless there are really compelling buy cases.

Although I do think we can do some selling of put options of US Regional banks ETF (KRE) or Bank of America (BAC) or JP Morgan. To take advantage if there are indeed big falls in the weeks or months ahead. Did do a small amount.

As of now I am just playing wait and see. No actions yet.

Maybe to shore up cash in case I want to leave my job and take a break.

Hi Happy RI, I am super sianz of my portfolio valuation in such horrendous market conditions. Despite the recent rally, especially, in REITs, I think that it will be a short-lived sucker rally as we may still be way off from a sustainable one. Oil price just went up again with OPEC+ playing around with supply. Not sure how this will pan out.

ReplyDelete