The 3 Stocks that I name them as Covid Brothers ( Prime, Elite and United Hampshire)

Amongst all the REITs I have, these 3 are the worse performing stocks in terms of share price. I call them the Covid brothers. All 3 are way off their IPO price, especially Prime and united Hampshire, both are US based. I wrote about United Hampshire in this post, even the CEO came out to say the high yield is not justified.

I wrote a piece about Elite in this post due to it's all eggs in 1 basket strategy in terms of tenant diversification. I also spoke about why i still chose to invest in it. I didnt write anything about Prime as it's business model is quite common.

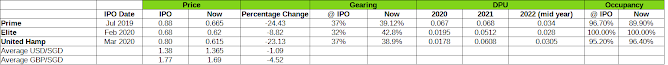

Abit of a comparison of how the REIT is doing now compared to IPO times. I even added forex rate to see if there is any correlation between the share price and forex rate. Not that I can see any to say the truth. Both US REITs are down close to 25% whereas Elite is down close to 10%. What did the 3 REITs do wrong to deserve such punishment in terms of pricing?

All 3 REITs went through the start of Covid, in fact IPO just right before covid. Talk about being really unlucky. It's definitely not the best time to IPO but nobody knew Covid will be such a big issue. The Singapore government didnt think it's going to affect that much until March 2020, which was the period Elite and United Hamp IPOed. Very Suay! At least Prime was about 1 USD before Covid hits. The other 2 have been below their IPO price ever since.

These 3 REITs went through the entire Covid period, relatively unscathed, so why isnt there much love from the retail investors? Is it because of the private placement by both the US REITs? Is it because of the war between Ukraine and Russia and the general sentiment turned negative since the start of the war? Or is it because of the inflation issue now? Do you know that Elite has an inflation hedge with build in inflation linked escalation?

In anycase, i feel that all 3 are punished by bad timing of IPO and all the unfortunate events that follow. However, all 3 REITs managed to maintain or improve their DPU throughout the most difficult 2 years of Covid period, to me that is a very positive sign. At the current share price, even with higher interest rate, the yield is still very much respectable.

I will most likely sell away some of my growth stocks that have appreciated more than 25% and reallocate them to these 3 stocks to take advantage of future growth.

Buck up, Covid brothers!

These scammers took advantage of SGX being the safe heaven of REITs listing...mom and pops put in their "blood sweat" money....hoping to enjoy higher retirement income all get screwed.....those bough Eagle already lost tills pents dropped....I am not surprise some had to cancel the retirement to go back to work....SGX really needs to do more....tightern the law....hold the manager and sponsor accountable for ficticious accounting number....it's not difficult to do imo...it will be good in the long run to maintain SG reputation as regional financial hub.

ReplyDeleteI dodged a bullet there as i didnt like hospitality REIT and I found the queen mary floating hotel dodgy right from the start...

DeleteYou might want to check this InvestingNote post about foreign reits listed in SGX https://www.investingnote.com/posts/2567729

ReplyDeletethanks for the post. Found the original post on sgtalks as well.

Delete