FINANCIAL REPORTING - UOB and Keppel Corp

My growth stocks are totally smoking my dividend stocks by a mile. Major laggard is of course those China linked stocks but it's within expectation. Both UOB and Kep Corp have appreciated by more than 20% and at the same time providing me with more than 6% dividend! Loving it. REITs need to buck up. Banks generally do well in high interest environment, so I will continue to keep UOB . For Kep Corp, their vision 2030 seems to be be intact and their plan to unlock value from their assets are working for them as well.

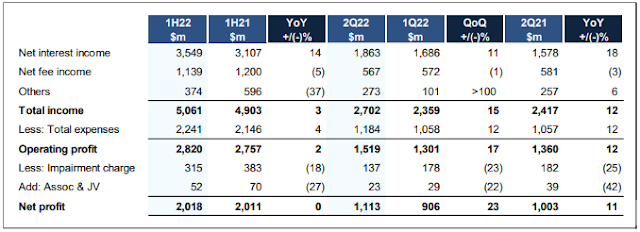

UOB

Dividend $0.60

Keppel Corp

Dividend $0.15

Congrats on your dividend income! I am looking forward to OCBC and Hong Leong Finance's results and dividends too!

ReplyDeleteYesterday UOB declared 0.6 but dropped 0.71 at closed...like that....it will potentially down to $27 after XD next week......that doesn't make sense to me...hopefully it was just knee jerk reaction to the Simao saga....US has cheong the last two sessions, SGX especially banks should response accordingly :p

ReplyDeletehahaha, yeah, so bizarre! I posted the entry and went out happily, didnt even bother to check share price! HAha. Too confident. It's definitely a reaction to the shimao saga for sure. Whether or not it is just a knee jerk reaction, lets see what happens on monday. I think it is a tiny hiccup in the grand scheme of things.

DeleteYeah, i also have OCBC, but very small amount. But still good dividend.

ReplyDelete