Financial Reporting Kick Off - Aims APAC & CLCT

The financial reporting season started a while back but I am only concern with the companies that I am vested in. To start the ball rolling, AA Reit and CLCT reported their earnings yesterday before the start of trade, which means dividend will be rolling in. The feeling is like getting red packet during CNY but of coz this is with strings attached. You put your faith (money) in the company's management to ensure he/she runs it properly and not to the ground.

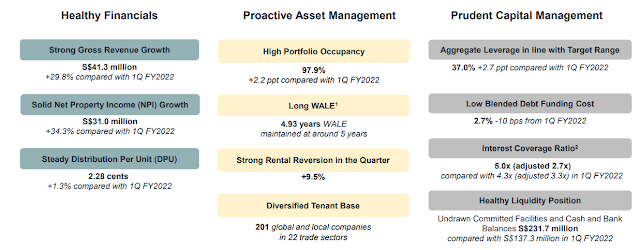

AA Reit in a nutshell

DPU is slightly lower compared to the previous quarter. Gearing is also slightly lower compared to the previous quarter, which is a good thing. AA Reit has been in my portfolio for a long time. The management has been delivering consistent results throughout the years. 无惊无险, but that's how REIT should be like isnt it?

CLCT in a nutshell

Another long timer in my portfolio. DPU could have been higher compared to the same period in previous year, but 3.6m is retained for COVID unknown. Result is still pretty decent due to the contributions from the business and logistics parks which is a good move by the management. The plan in the next 4 years is to increase the New Economy business from the current 21.9% to 30% and to expand into commercial/integrated developments. I hope by the end of the year, we will see more relaxation in terms of response to Covid.

Comments

Post a Comment