2018 Dividend Growth and Life Throwback.

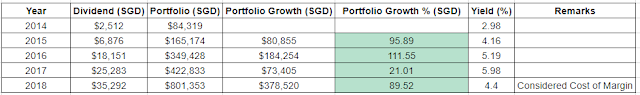

I realised I have never done a check on my dividend growth through the years. Well, there is always the first time! So on the last day of 2018, i shall do that. I started buying into REITs early 2014. Do note that the yield is a simple total dividend/total portfolio at the end of every year. It does not take into consideration annualised yield. Obviously some stocks were bought end of the year and only 1 quarter of dividend was considered. Anyway, you get the drift.

2018 was a big year for me in terms of life and investment.

1. Investment seems easier! I started going into margin purchase after i was introduced to it by a close friend. After doing the sums, i decided to go into it. I might have gone into it a little fast and furious. That's my problem. I am abit of a impulsive buyer. I just keep buying. My goal is to achieve a 1 mil portfolio in 2019 and a blended yield of at least 6% after considering the cost of margin. That will be provide me with 60k per year which is pretty considerable.

2. My crypto portfolio totally crashed and burnt. I put in 20k , and now its worth 8232. That is almost a 60% plunge. Well lessons learnt i guess, i knew it was a speculation from the start if you check back on my post 1 year ago. However, greed got the better of me and i didnt sell it when the portfolio was worth almost 100k. I will just hold for now and let's see if there another bullrun.

3. The baby arrived! This is a total game changer. My life is never the same again. I have never felt so tired in my whole life. However cliche it sounds, yes it is true, when you see the smile on the tiny little human's face, that is like magic. Then, your life starts to spin again when the baby starts throwing tantrums. Nah, it is not easy being a parent. My whole life revolves around the baby now as we didnt engage the help of the in laws or hiring a helper.

Alrighty, happy new year everyone. Onwards to a better and more fruitful 2019.

Great post! I, too, am pushing for the 1 mill asap. Congrats on the baby as well!

ReplyDeleteHappy NY

This comment has been removed by the author.

ReplyDeletecongrats!

ReplyDeletei wld like to explore more on the share financing idea. i thk maybank has the cheapest rate of ard 3% so the idea is to buy high dividend stocks or reits which are giving out >6% dividend so that u can pocket the balanced 3%+ right? any pit falls or things we need to take note of? as many pple says dont borrow to invest

Hi Jimmy L, thanks. Yeah, Maybank's rate was at 2.88% but has been raised up to 3.28% since the start of the year. It also depends on the type of shares you have with them in the margin account. Different grade and different currency has different interest. My post after this has some details on it.

DeleteYeah, basically that's it. You pocket the difference between the annual yield and margin interest. The only pit fall I guess is to suffer from the hated margin call (basically it means what u borrowed divided by total value of what you are holding(shares or cash) is less than 150percent). And to avoid it is to keep a safe buffer. For me I keep it at around 250percent, it gives me more buffer to deal with situation like the recent correction, and I only use it to buy stocks that are more stable and not that volatile.

For example I use it not just for some reits, but also for counter such as DBS. But for counter such as valuetronics, I prefer to use cash.

Well, I guess borrowing in a responsible manner to invest is fine. It's just like buying a property, do the sums, and borrow from the banks.

Anyway just my thoughts. :). Hope it helps!

Oh yeah the margin call scenario is for Maybank, other banks may have different percentage.

DeleteAnd not just difference between margin interest and dividend yield, if there is capital appreciation, you can sell as well.

thanks alot

Deletei am still abit scared scared of borrowing but i think its a doable idea

I was a little apprehensive as well. But start slow and you will realise it is not bad at all if you keep to a certain buffer.

Deletethanks

Deletewill keep that in mind