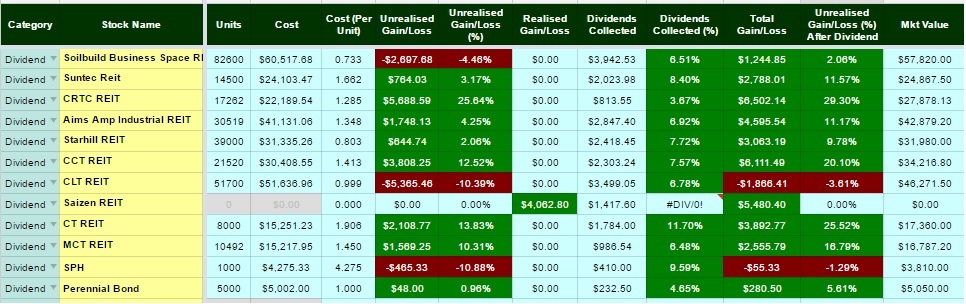

Oct Review of my portfolio

First post for the new month. Huat ah! Nothing major for my portfolio except that i subscribed to my soilbuild rights + excess. Also chose to re-invest the CRTC's distribution. Price wise for all my tickers seems to be holding stable. Cache Logistics Trust was moving up until the news came out that " CLT agrees(in protest) to accepting Schenker's rent under holding arrangement" until a resolution comes out from the Court proceedings. It doesnt spook me much, even if the rent stays status quo due to Court's resolution, the yield is still pretty good! Even with worse case scenario, the yield percentage (7.56% - Based on a report done by DBS in June) based on my unit price is still decent.

Im still waiting for Soilbuild to give an update with regards to the Technics property. Maybe i should start reducing what i have since now im back in the green thanks to the rights issue.

Comments

Post a Comment